Smart Ways to Spend your Tax Return

Share this article:

How are you spending your tax refund this year? Maybe you’re putting it towards a vacation or saving to buy something special. There’s nothing wrong with a little bit of responsible indulgence.

However, before you go out and spend your entire refund on fun, take a step back and try to determine the most financially responsible approach you can take with this money. Instead of spending all the funds on short-term indulgences, consider using some of it to improve your overall financial wellness. To help you get started, we’ve compiled this list of a few financially responsible ways to use your tax refund this year.

Build or boost your emergency fund

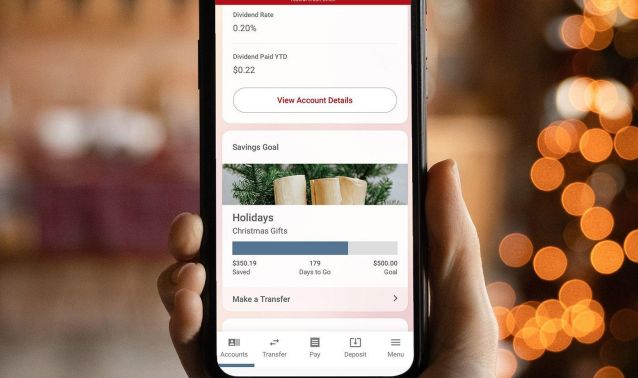

Having a well-endowed emergency fund is a crucial component to your financial health and stability. If you don’t have a fund with three to six months’ worth of living expenses set aside to cover unexpected events, work on setting one up now. Use some of your tax refund to start building your emergency fund or boost an existing one. Ascend offers both High-Yield Checking accounts and money market accounts so your money can grow while still giving you the accessibility you need for an emergency fund.

Pay down high-interest debt

High-interest debt can kill the best of budgets. If you’re carrying outstanding debt with high interest charges, consider using some of your tax refund to start paying it down. Decreasing your debt amount means more of your monthly payments will go toward your principal instead of interest. Additionally, knocking off a big chunk of your debt can potentially help you move to a lower interest rate. If you own a home and are looking to consolidate debt, a home equity loan could drastically reduce your interest rate.

Invest in your education

If you’ve been looking for a way to advance your career and increase your earning potential, this may be your chance. Consider furthering your professional education by allocating some of your tax refund to career workshops, conferences or additional certifications. Enhancing your qualifications and learning new skills can be the key to significant raises or a promotion at work, which will pay off for years to come.

Make home improvements

Spending some of your tax refund on improvements that increase the value of your home is an investment in your equity. In particular, kitchen facelifts and home expansions tend to offer a larger return on investment when the home is sold.

Start or contribute to a college fund

If you have children or plan to start a family in the future, consider allocating a portion of your tax refund to a college savings fund. Whether it’s opening a Certificate account to take advantage of higher rates and guarantee a return or exploring other college savings options, your contribution today will help ease the financial burden of higher education and empower your children to pursue their academic goals with confidence.

Invest in your retirement

If eligible, consider allocating a portion of your tax refund to your employer-sponsored 401(k) or an Individual Retirement Account (IRA). These contributions not only provide potential tax advantages, but they also harness the power of compounding, thus allowing your money to grow more over time. The earlier you start investing for retirement, the more you can potentially accumulate for your golden years.

With these tips, you’ll be able to utilize your tax refund in a way that benefits your long-term financial health. If you’d like more tips regarding tax filing, be sure to check out our blog on how to keep your information secure when filing taxes.