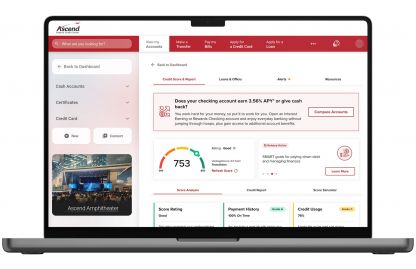

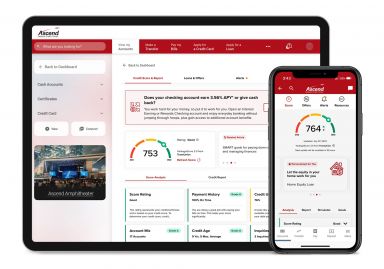

Digital Banking

Take banking with you—wherever you need it—with our fast, free, and convenient online and mobile banking app services.

View account balances

Transfer money to peers

Schedule payments

View past and pending payments

Apply for a loan, or make loan payments

View and download images of cleared checks

Chat with an Ascend representative

Security with two-factor authentication

Deposit checks from anywhere, anytime

Transfer funds between accounts

Make one-time payments

Set up recurring payments

Opt into Online Statements

Free credit score monitoring

Order and customize checks

Customize account alerts

Confirm deposits and withdrawals

Pay bills online, set up bill payees

Register for Digital Banking

Signing up to access digital banking is easier than ever. To register for an account, simply click below.

Meet SavvyMoney

We partnered with SavvyMoney to provide you with credit score monitoring and helpful resources — all at no cost to you. And no need to worry, SavvyMoney utilizes soft pulls that won’t impact your score.

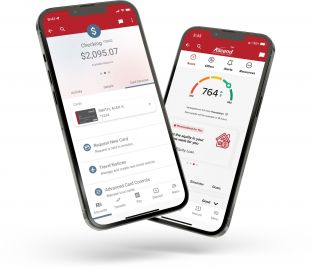

Download the Mobile App

Banking on the go? Ascend’s mobile app for digital banking makes managing your accounts convenient, secure and effortless — from anywhere, anytime.

- How do I transfer funds?

Choose Make a Transfer inside online banking. Select the accounts to move funds between. Enter the amount to transfer. Select the date you would like the transfer to occur. Then choose review. A confirmation screen will appear with transfer details where you can confirm, edit, or cancel the transaction. Transfers cannot be completed through the mobile app.

- How do I register for mobile deposit?

To register for mobile deposit, simply login through your mobile app, select the Deposit tab, then read and accept the terms and conditions. You should receive an email notification detailing whether your request was approved or denied.

- Are there limits to the amount I can deposit?

The credit union establishes mobile deposit limits based on account activity. If your registration is approved, your established limit will be included in the approval email.

- When I use mobile deposit, are funds applied to my account immediately?

It may take up to 24 hours for funds to appear in your account. Deposits made after-hours, on a weekend or holiday will not be processed until the next business day.

- How do I enable the camera on my iPhone or iPad?

Click Settings, the app name, Privacy, Enable the camera, then close the app and try again.

- How do I view my account balances?

Using your username and password, you can log in to the mobile app or digital banking to access your account dashboard, which will show the latest balances and transactions.

- How do I make a loan payment?

Loan payments can be made inside Ascend Digital Banking by selecting the Transfer tab and then choosing Transfer Between Accounts or Pay a Loan with a Debit Card.

- How do I view Online Statements?

When your statement is ready to view, login to digital banking, open the menu and select Documents & Statements, then click the month you wish to view.

- How do I set up Online Statements?

To change your opt-in settings, visit the digital banking menu. Select Documents & Statements, then change the toggle to Receive Online Statements only.

- How do I opt-out of Online Statements?

To change your opt-in settings, visit the digital banking menu. Select Documents & Statements. Members can toggle Online Statements on or off at their pleasure. For paper statements, a $1 fee applies for each statement, but this fee is waived for members 65 years of age and older and 17 years of age and younger.

- How long are statements available online?

The number of available online statements will depend on when you registered for the service. The maximum number of viewable online statements is 24 months.

- What are the requirements for downloading Online Statements?

To view Online Statements, you will need an updated version of Adobe Acrobat Reader.

Don't see the question you're looking for?

There are three different ways to become a member.