7 Steps to Build an Emergency Fund

Share this article:

Having an emergency savings fund can be critical in hard times. If the last few months have been tough on your finances and you’re feeling overwhelmed about where to begin, Ascend is here to help. Here’s a seven-step guide on how to build an emergency fund:

Set a goal

Before getting started on saving money, it’s a good idea to establish a tangible goal. Most experts recommend having 3 to 6 months’ worth of living expenses in an emergency fund, but it’s completely fine to start with a smaller, more attainable goal.

Review your budget and trim your spending

A good place to start finding those extra dollars for savings is by carefully reviewing your budget. Look for expenses that can make a difference in a monthly budget without dramatically affecting your quality of life. Think about subscriptions or services that are rarely used, a dining-out budget that can be scaled back, or expensive recreational activities that can be swapped with free alternatives. There’s no need to be miserly, but stripping your budget of some extras can give you the boost of cash you need each month to build up your savings.

Find a side hustle

Another great way to land extra funds is through a side job. There are many ways to earn extra income without a major time investment. Some options include taking surveys on sites like Survey Junkie or doing gig work for companies like Uber, DoorDash, and Rover.

Make a plan

Once you have a goal in place for building your savings, and you’ve maximized the possible monthly contributions toward savings each month, it’s time to create a plan. Map out a timeline of how long it’ll take to reach your goal when putting away as much as possible each month. Remember: the more aggressively you save now, the sooner you’ll reach your goal.

Start saving

It’s time to put the plan into action!

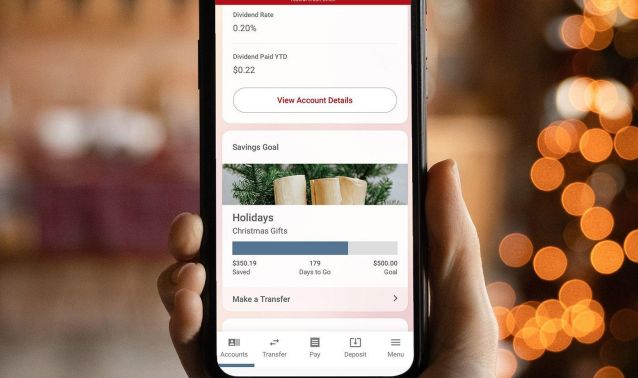

The best way to ensure regular saving happens each month is to make it automatic. Thanks to Ascend’s digital banking app, you can set up automatic transfers from your checking account to your savings on a designated day of the month. You may want to have the transfer go through several days after you receive your monthly salary, or it might work out better to put a smaller amount of money into savings each week.

Put unexpected windfalls into savings

To speed up the process of rebuilding depleted savings, you may want to resolve to put unexpected windfalls into an emergency fund or savings account. This can include tax refunds, a work bonus, and gift money. Earmarking future windfalls for savings can shorten the amount of time spent cutting corners in a budget and taking on extra jobs to build up a savings account.

Rebuilding an emergency fund and savings account from the bottom up isn’t easy. It takes commitment, hard work, and the ability to keep a long-term goal in mind; however, the security that comes from knowing you have a safety cushion to fall back on in case of a financial setback will make this goal worth the effort many times over.

If you’d like to learn more about building your emergency fund, check out our free course on building an emergency savings.