5 Steps to Take Before Making a Large Purchase

Share this article:

Bitten by the gotta-have-it bug? It could be a Peloton bike that’s caught your eye, or maybe you want to spring for a new entertainment system? Before you go ahead with the purchase, though, it’s wise to take a step back and follow these steps.

Step 1: Wait it out

Often, a want can seem like a must-have, but that urgency fades when you wait it out. Take a break for a few days before finalizing a big purchase to see if you really want it. For an extra large purchase, you can wait a full week, or even a month. After some time has passed, you may find that you don’t want the item after all.

Step 2: Consider your emotions

Before going ahead with your purchase, take a moment to identify the emotions driving the decision. Is this purchase being used as a means to fix a troubled relationship? Or maybe you’re going through a hard time and you’re using this purchase to help numb the pain. Be honest with yourself and take note of what’s really driving the purchase. Is it really in your best interest?

Step 3: Review your upcoming expenses

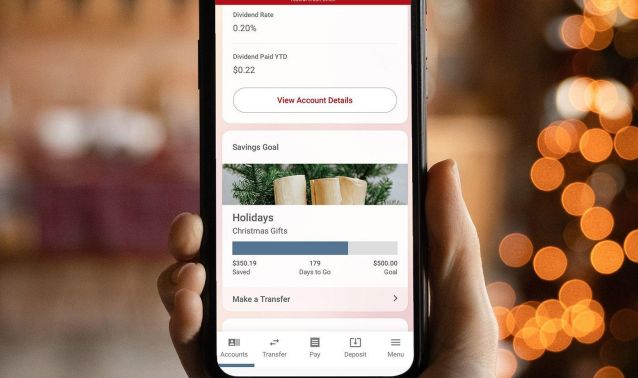

What large expenses are you anticipating in the near future? Even if you have the cash in your account to cover this purchase, you may need that money soon for an upcoming expense. Don’t spend money today that you’ll need tomorrow. A great way to track your budget is by utilizing Ascend’s digital banking app. It contains a host of tools that can help you follow a budget such as being able to schedule payments, being able to view account balances at any time, and automatically tracking your monthly spending so you know how much money you have to spend on big purchases.

Step 4: Find the cheapest source for this item

If you’ve decided you don’t want to go ahead with the purchase, there are still ways to save money. In today’s online world of commerce, comparison-shopping is as easy as a few clicks.

Step 5: Choose your payment method carefully

Cash can be your go-to choice if you have the funds on hand now. A low-interest credit card may offer purchase protection, just make sure you can meet your monthly payments. Luckily, Ascend has partnered with Savvy Money to provide all Ascend members with credit score monitoring and helpful resources — all at no cost to you or your credit score. With Savvy Money, you’ll be better able to gauge if purchasing through a credit card is right for you.

If you’re interested in joining a credit union that provides you with the tools you need to make these big purchases, look no further than Ascend! For more advice on saving and budgeting, be sure to check out our article, “5 Simple Steps to Start Saving”.