Quick Tips for Saving and Spending

Share this article:

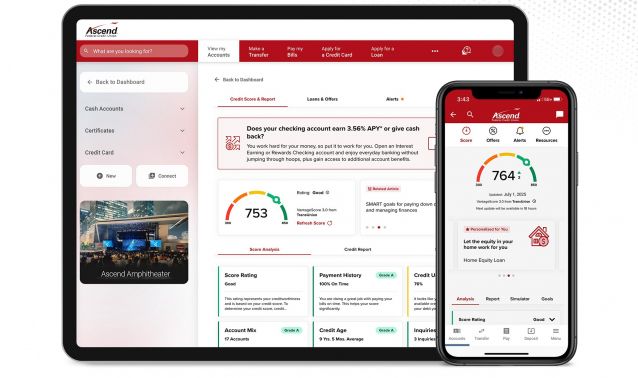

Start your saving plan today. Sign up for Ascend Digital Banking and download our mobile app.

Managing your money shouldn’t feel overwhelming. At Ascend Federal Credit Union, we believe financial peace of mind starts with having the right tools and support to help you stay on top of your budget. Whether you’re saving for something big or simply trying to make room for everyday spending, here are a few ways Ascend makes managing money easier.

Track What You Spend

Ascend Digital Banking provides you with the data you need to make informed decisions about your finances. Our Spending Analysis tool, found in the Ascend app, automatically categorizes your transactions, so you can see where your money is going each month. You can even set spending limits by category, helping you stay within your means and reach your goals faster.

Everything is presented in easy-to-read charts and graphs, making it intuitive to visualize your progress over time. Whether you're trying to cut back on impulse purchases or want to allocate more towards an emergency fund or holiday fund, Spending Analysis makes budgeting more approachable and effective.

See the Big Picture with SavvyMoney

While controlling your day-to-day spending is key to financial health, your credit score plays a major role in your long-term financial goals. That’s where SavvyMoney can help. This free feature, built directly into digital banking, gives you real-time access to your credit score, a detailed breakdown of what impacts it, and gives personalized recommendations on how to improve it.

You’ll also receive alerts about score changes, so you’re never caught off guard. Since checking your score through SavvyMoney doesn’t impact it, you can monitor your progress as often as you like. Whether you’re planning to finance a car, buy a home, or just want to feel more in control, SavvyMoney can help you stay informed.

Ascend is Here for You

Sometimes you need more than an app. That’s where our Financial Health Check-Ups come in. Schedule a free session either in-branch or virtually to get one-on-one time with a knowledgeable Ascend Financial Services Officer. Together, you’ll review your income, spending, debt, and savings to build a custom financial plan that works for you and your lifestyle.

Peace of mind starts with a plan and Ascend is here to help you build it.

Ascend is federally insured by the NCUA.