Protect Yourself from Fraud with Ascend

Share this article:

In today’s digital world, staying vigilant against fraud is more important than ever. At Ascend Federal Credit Union, we understand how crucial it is for you to feel secure about your finances. That’s why we offer a suite of fraud protection services designed to give you peace of mind.

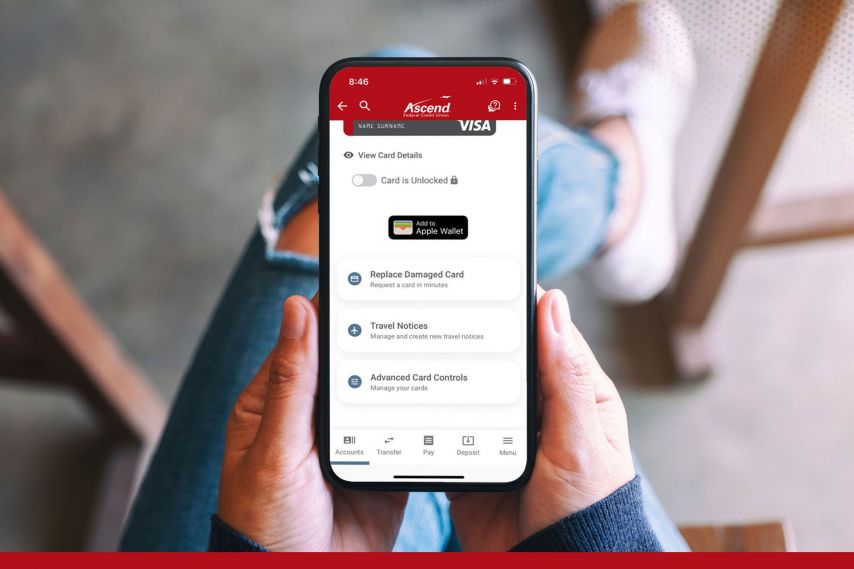

Card Services: Manage Your Cards with Ease

Have you ever misplaced your debit or credit card and worried it might be used by someone else? With Ascend Card Controls, you have the power to block and unblock your cards right from your mobile device. You can also:

- Block international in-store transactions.

- Set specific regions for in-store transactions.

- Control merchant and transaction types.

- Establish spending limits to help protect your finances.

Automated Fraud Alerts: Stay Informed and Protected

Our automated fraud alert system continuously monitors your account activity. If suspicious activity is detected, we’ll alert you immediately so you can take action. These alerts are a critical tool for safeguarding your account.

Travel Notice: Keep Your Card Working Smoothly While Traveling

Planning a trip? Notify Ascend about your travel plans through digital banking. This ensures uninterrupted card usage and helps prevent your transactions from being flagged as suspicious while you’re away.

Account Alerts: Stay on Top of Your Finances

With customizable account alerts, you can set up Ascend notifications via text, email, or push alerts for:

- Account balances

- Cleared checks

- Large withdrawals

- Loan payment due dates

- Login alerts

These alerts help you monitor your accounts in real-time and catch any unauthorized activity quickly.

SavvyMoney: Keep Tabs on Your Credit

All Ascend members enrolled in digital banking have access to SavvyMoney, a free credit score monitoring program that gives you real-time access to your latest credit score and report.

Not enrolled in digital banking yet? Easily register for your account today.

Be Aware of Treasury Check Fraud

Recently, there has been a rise in fraudulent U.S. Treasury checks nationwide. To protect yourself:

- Verify the correct routing transit number; all Treasury checks use routing numbers ending in 518 preceded by zeroes.

- Ensure the "U.S. Treasury" watermark is visible on both the front and back of the check.

- Be cautious with unsolicited checks, it could be a scam.

If you receive a U.S. Treasury check, contact the U.S. Treasury or the agency issuing the check directly through official channels to verify its legitimacy. Be cautious if the amount of the check seems unusually large or not consistent with what is expected. Scammers often send checks with an overpayment and ask for a portion of the money back. Remember, legitimate government agencies will never ask you to wire money or pay fees to receive grants or refunds.

Get Started Today

Fraud can happen to anyone, and it’s often unexpected. By utilizing fraud protection tools from Ascend, you can take proactive steps to protect your finances and personal information. Whether it’s managing your cards, receiving fraud alerts, or setting up travel notices, we’re here to help keep your finances safe. Login to digital banking to set up these essential services or contact us at 800-342-3086.