Preparing for the Holidays: Start Saving Now

Share this article:

Ready to start saving? Open an account at ascend.org or check out our tools within Ascend Digital Banking.

The holiday season might feel far away, but it’s closer than you think! Whether you’re planning a holiday party, gifts for loved ones, or seasonal travel, a little planning now can help reduce financial stress later. At Ascend Federal Credit Union, we’re here to help you save in a way that fits your lifestyle, so your holidays can be enjoyed with less stress.

Simplify Your Saving

One of the best ways to prepare for the holidays is by creating dedicated savings accounts. When your money is separated from your everyday spending, it’s easier to avoid dipping into your holiday fund for other expenses.

Try one of these options:

- Ascend Christmas Club Account: Save all year long with no minimum opening deposit and the option to set up automatic transfers. Plus, you can build your holiday savings effortlessly and withdraw your funds when you need them.

- Secondary Savings Account: Create a separate savings account labeled “Holiday Fund” to visually track your progress. Want to help your savings grow faster? Consider pairing your holiday fund with a High-Yield Checking or Money Market account from Ascend. You’ll earn higher dividends while keeping your funds easily accessible once the holidays roll around.

And the best part? You can open either of these accounts in just a few taps within Ascend Digital Banking. If you’re not sure where to start, consider setting a specific goal for your holiday spending and commit to saving a little each week. For example, if you set aside $25 per week starting now, you’ll have $600 saved by Christmas. Whether you choose to save with a Christmas Club or secondary savings account, starting now gives you time to build a strong holiday budget.

Use Digital Banking Tools to Stay on Track

Alongside our savings accounts, Ascend offers tools within digital banking designed to help you stay organized and on budget.

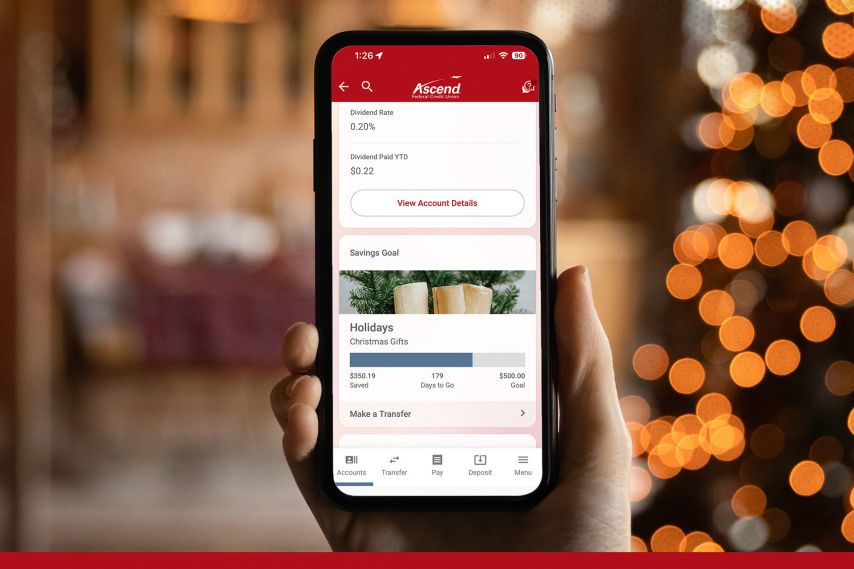

- Savings Goals: Set a custom goal and track your progress within the app.

- Automatic Transfers: Schedule regular deposits from your checking account to your holiday fund to make saving effortless.

The holidays are a time for giving and creating memories — not financial stress. By planning ahead, you’re giving yourself the gift of peace of mind. And with only a limited number of paydays left before the season begins, now’s the time to start saving for the holidays.

Ready to start saving? Open an account at ascend.org or check out our tools within Ascend Digital Banking.

Ascend is federally insured by the NCUA.