Put Your Money to Work: Comparing Money Market and Certificate Accounts

Share this article:

Money market accounts and certificate accounts are valuable interest-earning tools used to enhance your savings while ensuring the safety of your funds. On the surface, they may seem interchangeable as both are products offering interest yields with maximum peace of mind. However, choosing between the two ultimately depends on your specific financial needs. Understanding the differences between a money market and a certificate account is the key to determining which is the most appropriate account for your unique circumstances.

What is a Money Market?

A money market is a type of savings account used to generate a small amount of interest while protecting the principal. It tends to deliver interest rates that are higher than traditional savings accounts, but it often requires a higher minimum deposit. Some accounts also require a minimum balance to receive the highest rate.

The interest rates on money markets are variable, which means that they rise and fall with the interest rate market. Furthermore, federal regulations limit the number of transactions in money market accounts to six per month.

What is a Certificate Account?

Certificate accounts are designed around fixed interest rates associated with specific maturity dates. Generally, opting for a lengthier deposit period results in a higher interest rate. Certificate accounts are issued with maturities that range in length from one month up to 5 years. With traditional certificate accounts, institutions may charge a penalty for withdrawing money prior to the maturity date.

Choosing the Right Account

Generally, a money market account is better if you have an immediate need for cash. If an emergency arises, you wouldn’t want to pay a penalty for prematurely withdrawing money from a certificate account before the maturity date.

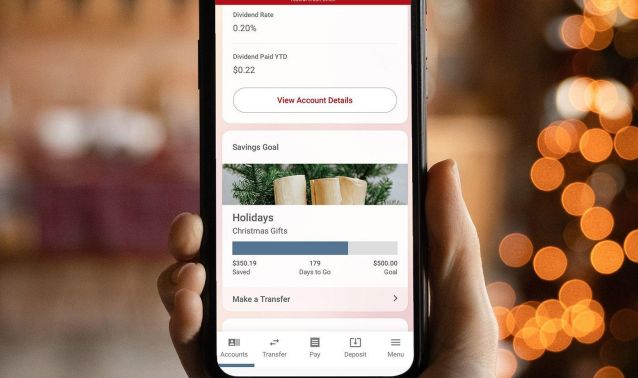

On the other hand, if you’re looking to maximize your earned interest, a certificate account may be a better option for you. If you already have a robust emergency fund, you may be able to lock in a higher rate. Certificate accounts are often used to fund goals within a 5-year time frame, when you may not want to risk the price fluctuation of market-based options, such as a stock mutual fund.

Ultimately, both money market accounts and certificate accounts offer a great balance of security and potential interest earned. By comprehending the nuances of each account type, you can confidently make the decision that aligns with your short-term needs and long-term goals. If you’d like to learn more about the array of account types that Ascend offers, you can find more information here.

Federally insured by NCUA. Not subject to loss of principal.