The Importance of a Rainy Day Fund

Share this article:

Life is full of surprises, and some of them can be expensive. Whether it’s a medical emergency, car repairs or any other unforeseen event, having a financial safety net can provide a sense of security and stability. Let’s take a look at why it’s so important to save for rainy days.

Stay out of debt

When life throws an expensive surprise your way and you don’t have money to pay for it, you may fall into debt just to get by. On the flip side, if you had a well-padded emergency fund, you’d have the cash you need to fall back on in case of an emergency.

Flexibility and freedom

Saving for a rainy day brings an element of flexibility and freedom to your life. It enables you to pursue new opportunities, take risks and make major life changes without the constant fear of financial instability. Whether it’s starting a business, furthering your education or taking a sabbatical, savings provides the support you need to confidently explore these possibilities.

Peace of mind

Financial stress can take a toll on your physical and mental well-being. Constantly worrying about money can lead to anxiety, depression, strained relationships and more. Knowing you have an emergency fund prepared and ready for a rainy day can offer a sense of security and peace of mind.

Achieve long-term financial goals

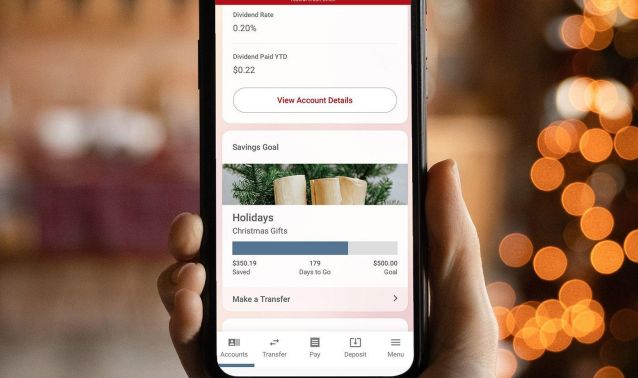

Saving for a rainy day is not just about preparing for emergencies; it’s also a stepping stone toward achieving long-term financial goals. Whether it’s buying a house, starting a family or planning for retirement, having savings will help you stay on track.

Life's unpredictability demands a proactive approach to financial preparedness, and a well-funded safety net serves as a shield against unexpected expenses that can otherwise lead to debt and financial strain.

For additional tips on how you can boost your savings, visit Ascend’s blog on “5 Simple Steps to Start Saving”.