Changing Financial Institutions with Confidence

Share this article:

Switching financial institutions can often be an involved and daunting process. Here at Ascend, we've provided you with a comprehensive checklist to help you navigate the transition smoothly and with confidence.

Research & Compare

It’s crucial to find the financial institution that will serve you best for your current chapter in life. A financial institution with great credit card rates may not mean much to you if you’re in the market for a certificate or money market account. Take your time to research and compare different options, including learning the differences between credit unions and banks. Complete research is the foundational step for choosing your future financial home, so be thorough!

Open a New Account

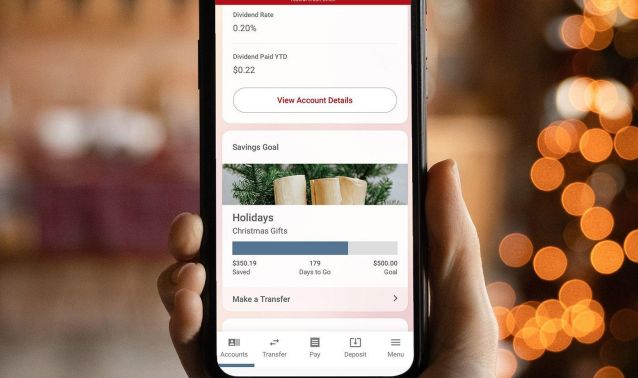

Once you’ve done your research and you’ve selected your financial institution of choice, it’s time to open an account! This can oftentimes feel overwhelming, but the good news is you typically have multiple ways to go about this. You can go the traditional route and visit the nearest branch, or you can open an account online.

Transfer Automatic Payments & Withdrawals

Now that you’ve opened an account with your new financial institution, it’s time to transfer everything over from your previous bank or credit union. This can be the most involved step of all, as many people have multiple automatic withdrawals and payments tied to their account. Ascend has provided you with a checklist of steps you can take to ensure this process goes as smoothly as possible:

- Identify all automatic payments and withdrawals, including utility bills, loan payments, subscriptions, memberships, and any other recurring expenses.

- Create a list of each service provider or organization associated with these automatic payments and withdrawals.

- Contact each service provider individually to update your payment details with your new account information or use their website to update payment methods.

- Keep a record of each service provider's confirmation and note any important dates or payment cycles to stay organized.

- Monitor your old account for any residual automatic payments or withdrawals to ensure they have been switched to your new account.

- Once all automatic payments and withdrawals have been successfully transferred to your new account, you can confidently close your old account to complete the transition.

Now you have all the information you need to switch financial institutions with confidence. If you’ve done your research and decided that Ascend Federal Credit Union is the financial institution for you, be sure to schedule an in-branch appointment or open an account online! Once you’re signed up, you can read about all the great perks that come with being a member of Ascend.