3 Tips for Managing Subscriptions

Share this article:

Do you know how much you spend on subscriptions each month? From entertainment to gym memberships, subscription charges can slip under the radar and silently drain your bank account. These expenses can add up over time, stretching your budget thin and even making you forget what you are subscribed to. As such, routinely evaluating your subscription services can help you better understand your financial situation, and it may allow you to free up money that’s better served elsewhere. Here are some tips for managing your monthly subscriptions:

Simplify your subscriptions

Keeping track of your subscriptions can be difficult, especially when they're billed on different days. To help simplify things, consider syncing the payments on all your subscription services. This way, you can review them all at once instead of losing track over the month. Being able to review all your subscription charges at once can help put into perspective how much you’re spending monthly—and it will help you understand which ones are providing the most value to your life.

You can also put all your subscriptions on a single debit or credit card, further simplifying the process.

Set reminders for free trials

Free trials can be tempting, but it’s very easy to forget about them and then get hit with an unwanted charge. In a best-case scenario, you can cancel the free trial as soon as you enter your payment information while still having access to the service for the rest of the trial period. Otherwise, be sure to set a reminder to cancel the subscription before the end date if you decide not to continue with it.

Re-evaluate often

Regularly auditing your subscriptions is perhaps the single most important thing you can do to keep your subscriptions under control. Make a list of your subscriptions and go through them, noting how expensive they are, how often you use them, and if a cheaper alternative exists. Cut subscriptions that you just don’t use or that you can do without. Small changes, like cancelling a $10 monthly subscription, will save you $120 a year! Subscriptions add up fast, but by evaluating them often, you can cut away the ones that aren’t adding value to your life.

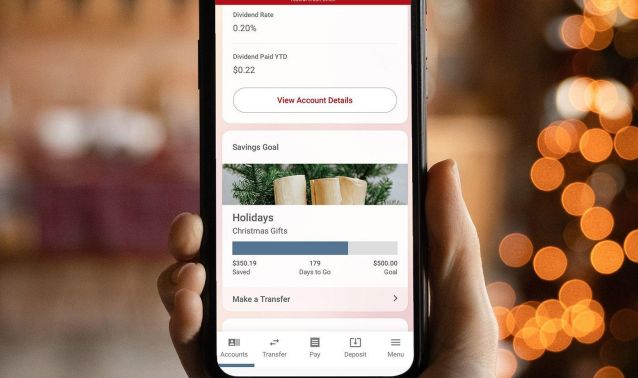

Taking charge of your monthly subscriptions requires diligence, but the payoff is worth it. By simplifying, setting reminders, and regularly reassessing your subscriptions, you can achieve a healthier financial outlook. From our budget worksheets, financial education courses, digital banking money management, and more, Ascend offers a variety of tools that can help you manage your subscriptions with ease. Additionally, if you are just getting started and want some additional budgeting tips, check out our blog on 4 easy steps to start your budget.